Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

The Perks of Buying a Fixer-Upper

Affordability, Buying Tips, For BuyersThere’s no denying affordability is tough right now. But that doesn’t mean you have to put your plans to buy a home on the back burner.If you’re willing to roll up your sleeves (or hire someone who will), buying a house that needs some…

Two Resources That Can Help You Buy a Home Right Now

Affordability, Buying Tips, First-Time Buyers, For BuyersA recent report from Realtor.com says 20% of Americans don’t think homeownership is achievable. Maybe you feel the same way. With inflation driving up day-to-day expenses, saving enough to buy your first home is more of a challenge. But here’s…

Why Moving to a More Affordable Area Makes Sense

AffordabilityMoving to a more affordable area could be the fresh start you need to get ahead financially. While some markets are certainly more affordable than others, know that working with a trusted real estate agent to find what fits your budget and your…

What Will It Take for Prices To Come Down?

Affordability, Home Prices, InventoryYou may be wondering if home prices are going to crash. And believe it or not, some people might even be hoping this happens so they can finally purchase a more affordable home. But experts agree that's not what's in the cards – and here's…

Is a Fixer Upper Right for You?

Affordability, Buying Tips, For BuyersLooking to buy a home but feeling like almost everything is out of reach? Here’s the thing. There’s still a way to become a homeowner, even when affordability seems like a huge roadblock – and it might be with a fixer upper. Let’s dive…

What To Expect from Mortgage Rates and Home Prices in 2025

Affordability, For Buyers, For Sellers, Home Prices, Mortgage RatesCurious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices.Whether…

The Benefits of Using Your Equity To Make a Bigger Down Payment

Affordability, Equity, For Buyers, Home Prices, Mortgage RatesDid you know? Homeowners are often able to put more money down when they buy their next home. That’s because, once they sell, they can use the equity they have in their current house toward their next down payment. And it’s why as home equity…

The Top 3 Reasons Affordability Is Improving

Affordability, Home Prices, Infographics, Mortgage RatesSome HighlightsAffordability is based on three key factors: mortgage rates, home prices, and wages.And today, it’s improving quickly as rates come down, prices level off, and wages climb. If you put your search on pause because it was too…

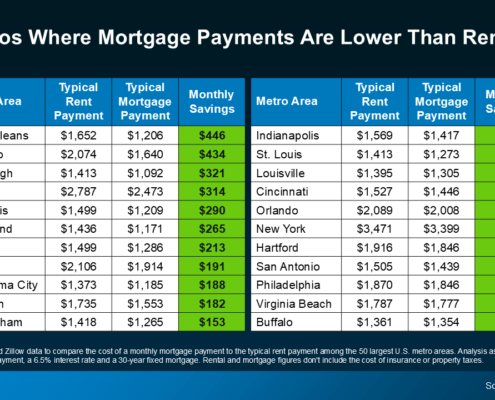

Buying Beats Renting in 22 Major U.S. Cities

Affordability, For Buyers, Home Prices, Inventory, Mortgage RatesThat’s right—according to a recent study from Zillow, in 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments (see chart below):As mortgage rates have eased off their recent peak, home prices have…

The Latest Builder Trend: Smaller, Less Expensive Homes

Affordability, For Buyers, New ConstructionEven though affordability is improving, buying a home can still feel tough right now. But here’s some good news: builders are focusing their efforts on building smaller homes, and they’re offering key incentives to buyers. And both of these…