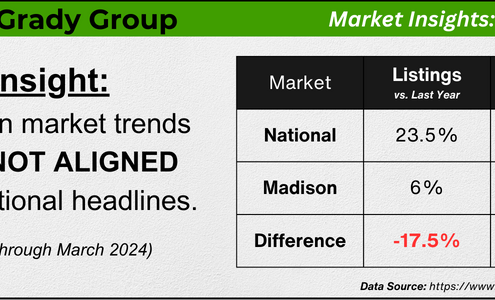

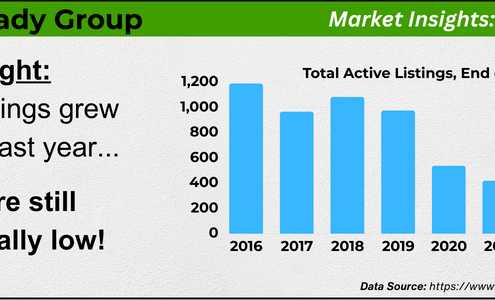

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

Don’t Let Student Loans Delay Your Homeownership Dreams

Buying Myths, Down Payments, First Time Home Buyers, For Buyers

If you’re looking to buy a home, you may be wondering how your student loan debt could impact those plans. Do you have to wait until you’ve paid off your student loans before you can buy your first home? Or could you qualify for a home…

How To Hit Your Homebuying Goals This Year [INFOGRAPHIC]

Down Payments, First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

Some Highlights

If you’re looking to buy a home, you may want to put these items on your to-do list to ensure you hit your goals.

It’s important to start working on your credit and saving for a down payment early. When you’re ready…

How Much Do You Need for Your Down Payment?

Buying Myths, Down Payments, For Buyers

As you set out on your homebuying journey, you likely have a plan in place, and you’re working on saving for your purchase. But do you know how much you actually need for your down payment?

If you think you have to put 20% down, you may have…

The Perks of Putting 20% Down on a Home

Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

If you’re thinking of buying a home, you’re probably wondering what you need to save for your down payment. Is it 20% of the purchase price, or could you put down less? While there are lower down payment programs available that allow qualified…

Why It Just Became Much Easier To Buy a Home

Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up Buyers

Since the pandemic began, Americans have reevaluated the meaning of the word home. That’s led some renters to realize the many benefits of homeownership, including the feelings of security and stability and the financial benefits that come…

Tips for Single Homebuyers: How To Make Your Dream a Reality

Buying Myths, Down Payments, First Time Home Buyers, For Buyers

If you’re living on your own and looking to buy a home, know that you can make your dream a reality with thoughtful planning and the right team of experts. Research from Freddie Mac shows 28% of all households (36.1 million) are sole-person,…

VA Loans: Helping Veterans Achieve Their Homeownership Dreams

Buying Myths, Down Payments, For Buyers, Time-sensitive

The purpose of Veterans Affairs (VA) home loans is to provide a pathway to homeownership for those who have sacrificed so much by serving our nation. As the Veterans Administration says of the program:

“The objective of the VA Home Loan…

Is a 20% Down Payment Really Necessary To Purchase a Home?

Buying Myths, Demographics, Down Payments, First Time Home Buyers, For Buyers, Gen Z, Millennials

There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from purchasing a home. For over half…

The Truths Young Homebuyers Need To Hear

Buying Myths, Demographics, Down Payments, First Time Home Buyers, For Buyers, Gen Z, Interest Rates, Millennials, Pricing, Rent vs. Buy

For many young or first-time homebuyers, purchasing a home can feel intimidating. A recent survey shows some homebuyers ages 25 to 40 may be unsure about the homebuying process and what they can afford. It found:

“1 in 4 underestimated their…

What To Expect as Appraisal Gaps Grow

Buying Myths, Down Payments, For Buyers, For Sellers, Move-Up Buyers, Pricing, Selling Myths

In today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association of Realtors…