Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

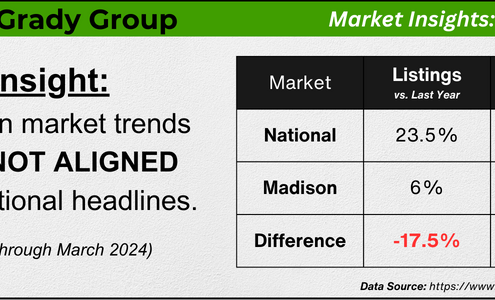

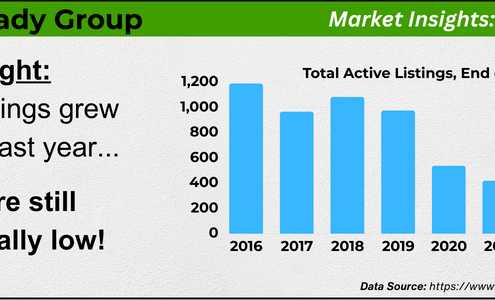

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

Things To Avoid After Applying for a Mortgage [INFOGRAPHIC]

Buying Tips, For Buyers, Infographics, Mortgage RatesSome HighlightsThere are a few key things you’ll want to avoid after applying for a mortgage to make sure you’re in the best position when you get to the closing table.Don’t change bank accounts, apply for new credit, make any large purchases…

Homeownership: The Heart of the American Dream

Buying Tips, Equity, For BuyersEveryone’s vision for the future is personal and unique. But for many, common goals include success, freedom, and prosperity — values closely tied to having your own home and the iconic feeling of achieving the American Dream.A recent survey…

Real Estate Still Holds the Title of Best Long-Term Investment

Buying Tips, For Buyers, Home Prices, Mortgage RatesWith all the headlines circulating about home prices and mortgage rates, you may be asking yourself if it still makes sense to buy a home right now, or if it’s better to keep renting. Here’s some information that could help put your mind…

The Difference Between an Inspection and an Appraisal

Buying Tips, For BuyersWhen you decide to buy your first home, you may come across a number of terms and conditions you’re not familiar with. While you may have a general idea of what an inspection is, maybe you’re not sure why you need one or how it’s different…

Focus on Time in the Market, Not Timing the Market

Economy, For Buyers, Home PricesShould you buy a home now or should you wait? That’s a big question on many people’s minds today. And while what timing is right for you will depend on a lot of other personal factors, here’s something you may not have considered.If you’re…

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

For Buyers, For Sellers, Forecasts, Home Prices, InventoryAs we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales.Home Prices Are Expected To Climb ModeratelyHome prices are forecasted to rise at a more normal pace. The graph…

Why a Vacation Home Is the Ultimate Summer Upgrade

Buying Tips, For Buyers, Luxury / VacationSummer is officially here and that means it’s the perfect time to start planning where you want to vacation and unwind this season. If you’re excited about getting away and having some fun in the sun, it might make sense to consider if owning…

What You Need To Know About Today’s Down Payment Programs

Buying Tips, First-Time Buyers, For BuyersThere's no denying it's gotten more challenging to buy a home, especially with today's mortgage rates and home price appreciation. And that may be one of the big reasons you’re eager to look into grants and assistance programs to see if there’s…

Do Elections Impact the Housing Market?

For Buyers, For SellersThe 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market.It’s a great question because…

Real Estate Is Still the Best Long-Term Investment [INFOGRAPHIC]

Equity, For Buyers, Infographics, Rent vs. BuySome HighlightsAccording to a recent poll from Gallup, real estate has been voted the best long-term investment for twelve straight years.That’s because a home is so much more just than a roof over your head. It’s also an asset that typically…