Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

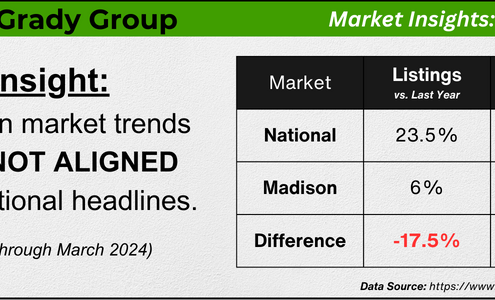

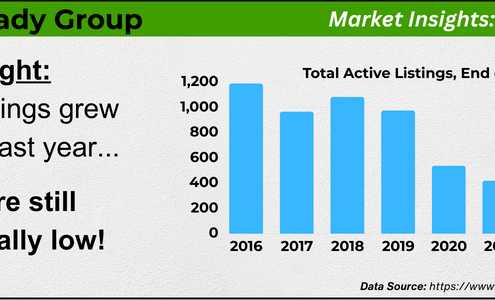

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

Why the Median Home Price Is Meaningless in Today’s Market

For Buyers, For Sellers, Housing Market Updates, PricingThe National Association of Realtors (NAR) will release its latest Existing Home Sales (EHS) report later this week. This monthly report provides information on the sales volume and price trend for previously owned homes. In the upcoming release,…

Saving for a Down Payment? Here’s What You Need To Know.

Down Payments, First Time Home Buyers, For Buyers, Move-Up BuyersIf you're planning to buy your first home, then you're probably focused on saving for all the costs involved in such a big purchase. One of the expenses that may be at the top of your mind is your down payment. If you’re intimidated by how…

How Owning a Home Grows Your Wealth with Time [INFOGRAPHIC]

First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers, PricingSome HighlightsIf you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.Over time, homeownership allows you to build equity. On average, nationwide home prices appreciated by 290.2% over the…

Why Buying or Selling a Home Helps the Economy and Your Community

For Buyers, For SellersIf you're thinking about buying or selling a house, it's important to know that it doesn't just affect your life, but also your community.The National Association of Realtors (NAR) releases a report every year to show how much economic activity…

A Drop in Equity Doesn’t Mean Low Equity

For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers, PricingYou may see media coverage talking about a drop in homeowner equity. What’s important to understand is that equity is tied closely to home values. So, when home prices appreciate, you can expect equity to grow. And when home prices decline,…

Your Needs Matter More Than Today’s Mortgage Rates

For Buyers, For Sellers, Interest Rates, Move-Up BuyersIf you’re thinking about selling your house right now, chances are it’s because something in your life has changed. And, while things like mortgage rates are a key part of your decision on what you’ll buy next, it’s important to not…

Are Home Prices Going Up or Down? That Depends…

First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers, PricingMedia coverage about what’s happening with home prices can be confusing. A large part of that is due to the type of data being used and what they’re choosing to draw attention to. For home prices, there are two different methods used to…

Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market [INFOGRAPHIC]

For Buyers, For Sellers, Foreclosures, Housing Market Updates, Infographics, PricingSome HighlightsComparing housing market metrics from one year to another can be challenging in a normal housing market – and the last few years have been anything but normal. In a way, they were ‘unicorn’ years.Expect unsettling housing…

This Real Estate Market Is the Strongest of Our Lifetime

For Buyers, For Sellers, Housing Market UpdatesWhen you look at the numbers today, the one thing that stands out is the strength of this housing market. We can see this is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our…

The Main Reason Mortgage Rates Are So High

For Buyers, Interest RatesToday’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be asking yourself…