Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

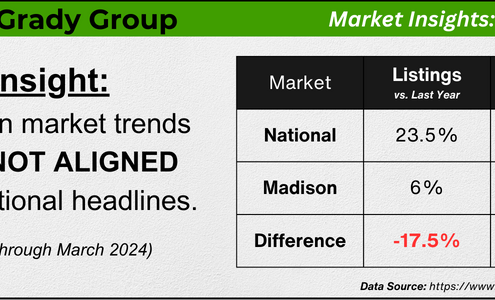

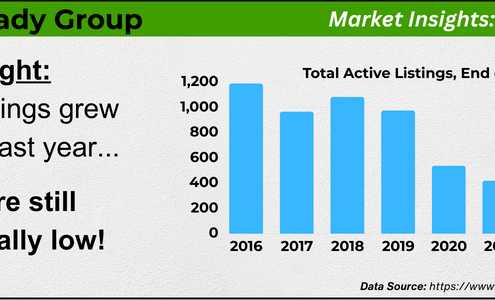

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

What You Need To Know About Pre-Approval

Buying Tips, For Buyers, InfographicsSome HighlightsBefore you even start looking at homes, there’s something you should do first – and that’s get pre-approved for your mortgage.Pre-approval is when a lender checks your finances and decides how much you’re qualified to…

Is the Housing Market Starting To Balance Out?

For Buyers, InventoryFor years, sellers have had the upper hand in the housing market. With so few homes for sale and so many people who wanted to purchase them, buyers faced tough competition just to get an offer accepted. But now, inventory is rising, and things…

Buying Your First Home? It’s Okay To Feel Nervous

Buying Tips, First-Time Buyers, For BuyersBuying your first home is exciting, but let’s be real – it can also feel overwhelming. It’s a big step, and with that comes plenty of questions. Am I making the right decision? Can I really afford this right now? Will I be able to make…

Mortgage Rates Hit Lowest Point So Far This Year

For Buyers, Mortgage RatesIf you’ve been holding off on buying a home because of high mortgage rates, you might want to take another look at the market. That’s because mortgage rates have been trending down lately – and that gives you a chance to jump back in.Mortgage…

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

Buying Tips, First-Time Buyers, For Buyers, Home PricesAt one point or another, you’ve probably heard someone say, “Yesterday was the best time to buy a home, but the next best time is today.”That’s because nationally, home values continue to rise. And with mortgage rates still stubbornly…

Headed Back Into the Office? You May Decide To Move

Buying Tips, For BuyersIt’s no secret that remote work has surged over the last few years. And that flexibility gave a lot of people the freedom to move — and work — from wherever they wanted.But now, a growing number of companies are requiring employees to…

Is a Newly Built Home Right for You? The Pros and Cons

Buying Tips, For Buyers, New ConstructionWhen searching for a home, you don’t want to skip over new builds as an option. Right now, there are more newly built homes to choose from than there would normally be in the market. And those added choices come with some pretty incredible…

Is It Better To Rent or Buy a Home Today?

For Buyers, Infographics, Rent vs. BuySome HighlightsA study shows that 70% of prospective buyers fear the long-term consequences of renting. And here’s why.Rent usually rises over time and that can make it harder to save up to buy a home. But when you buy, you can stabilize…

Is an Accessory Dwelling Unit Right for You? Here’s What To Know

Buying Tips, For BuyersAre you having a hard time finding the right home in your budget? Or maybe you already own a home but could use some extra income or a designated space for aging loved ones. Either way, accessory dwelling units (ADUs) could be the smart solution…

The Return to Urban Living — Why More People Are Moving Back to Cities

Buying Tips, For BuyersAfter years of suburban and rural migration during the pandemic, cities have been making a comeback in the past couple of years. According to the National Association of Realtors (NAR), the percentage of people moving to cities has risen to…