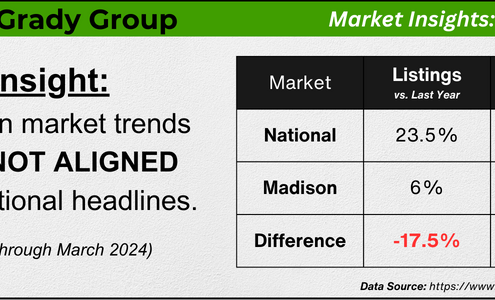

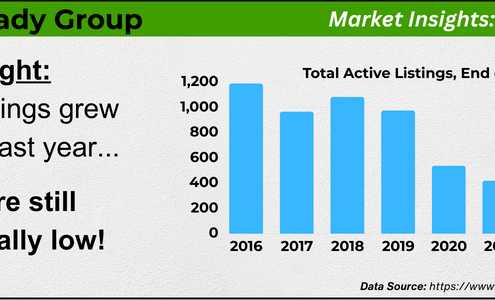

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

Could a Multigenerational Home Be the Right Fit for You?

Baby Boomers, Demographics, First Time Home Buyers, For Buyers, Millennials, Move-Up BuyersDuring the pandemic, many of us reexamined the meaning of home for ourselves and our loved ones. Today, that can be seen in the recent rise in multigenerational households. According to Jessica Lautz, Deputy Chief Economist and Vice President…

Is It Really Better To Rent Than To Own a Home Right Now?

First Time Home Buyers, For Buyers, Move-Up BuyersYou may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on.A lot of the time, these reports…

What You Should Know About Rising Mortgage Rates

First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up BuyersAfter steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes less affordable. So, if…

One Major Benefit of Investing in a Home

First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up BuyersOne of the many reasons to buy a home is that it’s a major way to build wealth and gain financial stability. According to Freddie Mac:“Building equity through your monthly principal payments and appreciation is a critical part of homeownership…

How To Make Your Dream of Homeownership a Reality

Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up BuyersAccording to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and nonfinancial benefits, so that interest…

A Smaller Home Could Be Your Best Option

Baby Boomers, Demographics, For Buyers, For SellersMany people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief Economist and…

The Two Big Issues the Housing Market’s Facing Right Now

For Buyers, For Sellers, Housing Market Updates, Interest RatesThe biggest challenge the housing market’s facing is how few homes there are for sale. Mark Fleming, Chief Economist at First American, explains the root causes of today’s low supply:“Two dynamics are keeping existing-home inventory historically…

Wondering What’s Going on with Home Prices?

For Buyers, For Sellers, Housing Market Updates, PricingThe recent changes in home prices are top of mind for many as the housing market begins gearing up for spring. It can be hard to navigate misleading headlines and confusing data, so here’s what you should know about today’s home prices.Local…

Should You Consider Buying a Newly Built Home?

First Time Home Buyers, For Buyers, Move-Up Buyers, New ConstructionIf you’re thinking about buying a home, you might be focusing on previously owned ones. But with so few houses for sale today, it makes sense to consider all your options, and that includes a home that’s newly built.The Number of Newly Built…

Why It’s Easy To Fall in Love with Homeownership

First Time Home Buyers, For Buyers, Move-Up BuyersNo matter how the housing market changes, there are some things about owning a home that never change—like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives…