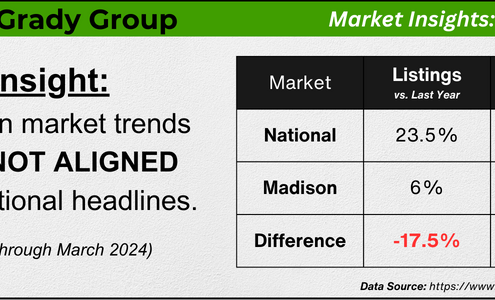

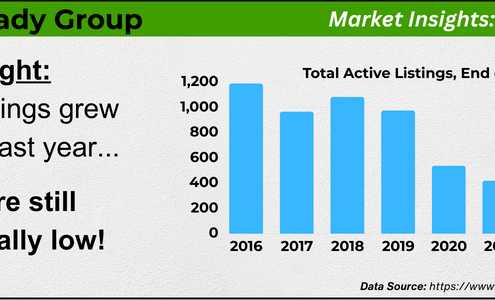

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

Smaller Homes, Bigger Opportunities: The Homebuilder Trend Buyers Love

Buying Tips, For Buyers, Home Prices, Mortgage RatesIt’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. But, if you don’t need a ton of space, you may find you have more…

Why More People Are Buying Multi-Generational Homes Today

Buying Tips, For BuyersToday, 17% of homebuyers are choosing multi-generational homes — that’s when you buy a house with your parents, adult children, or even distant relatives. What makes that noteworthy is that 17% is actually the highest level ever recorded…

When Is the Perfect Time To Move?

For Buyers, Home Prices, Mortgage RatesIt’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices will fall. But here’s what…

One Homebuying Step You Don’t Want To Skip: Pre-Approval

For Buyers, Home PricesThere’s one essential step in the homebuying process you may not know a whole lot about and that’s pre-approval. Here’s a rundown of what it is and why it’s so important right now.What Is Pre-Approval?Pre-approval is like getting a green…

The Truth About Credit Scores and Buying a Home

Buying Tips, For BuyersYour credit score plays a big role in the homebuying process. It’s one of the key factors lenders look at to determine which loan options you qualify for and what your terms might be. But there’s a myth about credit scores that may be holding…

What To Save for When Buying a Home

Agent Value, Buying Tips, For BuyersKnowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process.Here are just a few things experts say you should…

Expert Forecasts for the 2025 Housing Market

For Buyers, For Sellers, Forecasts, Home Prices, Mortgage RatesWondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home? The best way to get that information is to lean on the pros.Experts are constantly updating and…

Time in the Market Beats Timing the Market

Equity, For BuyersTrying to decide whether it makes more sense to buy a home now or wait? There’s a lot to consider, from what’s happening in the market to your changing needs. But generally speaking, aiming to time the market isn’t a good strategy –…

Get Ready To Buy a Home in 2025

Buying Tips, For Buyers, InfographicsSome HighlightsIf buying a home is on your goal sheet this year, here’s how to make it happen.Focus on improving your credit, planning for your down payment, getting pre-approved, and prioritizing your wish list.But first, connect with a trusted…

New Year, New Home: How To Make It Happen in 2025

Buying Tips, For BuyersThis is the time when a lot of people take a moment to reflect and set their goals for this year. And as you picture what you want your 2025 to look like, one thing that may pop into your mind is the vision of you in a new home. But how do you…