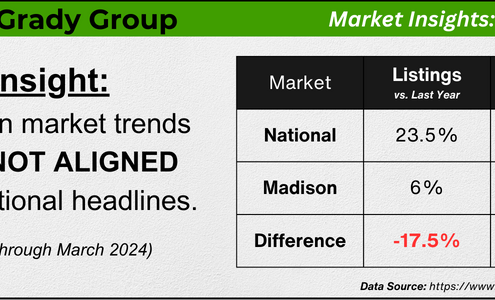

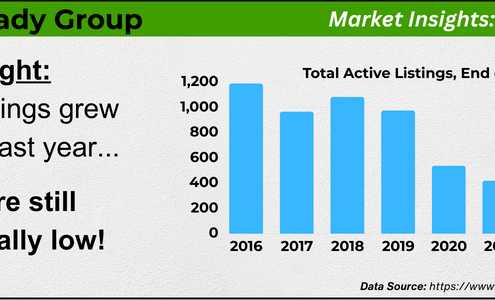

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

What You Can Do When Mortgage Rates Are a Moving Target

Buying Tips, For Buyers, Mortgage RatesHave you seen where mortgage rates have been lately? One day they go down a little. The next day, they go back up again. It can feel confusing and even frustrating if you’re trying to decide whether now’s a good time to buy a home.Take a…

A Recession Doesn’t Mean a Housing Crisis

Economy, Infographics, Mortgage RatesSome HighlightsThere’s a lot of talk about a recession lately and how the odds of one are rising. If you’re wondering what that means for the housing market, here’s what the data tells us.While you may remember the price crash in 2008,…

4 Things To Expect from the Spring Housing Market

For Buyers, For Sellers, Home Prices, Mortgage RatesSpring is in full swing, and the housing market is picking up along with it. And if you’ve been wondering whether now is the right time to buy or sell, here’s the inside scoop on why this spring may be a great time to make your move.1. There…

Mortgage Rates Hit Lowest Point So Far This Year

For Buyers, Mortgage RatesIf you’ve been holding off on buying a home because of high mortgage rates, you might want to take another look at the market. That’s because mortgage rates have been trending down lately – and that gives you a chance to jump back in.Mortgage…

How To Buy a Home Without Waiting for Lower Rates

Forecasts, Mortgage RatesMany people are hoping mortgage rates will come down before they buy a home. But will that actually happen? According to the latest forecasts, experts say rates will decline, but not by as much as a lot of people want.The good news? Even if…

Smaller Homes, Bigger Opportunities: The Homebuilder Trend Buyers Love

Buying Tips, For Buyers, Home Prices, Mortgage RatesIt’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. But, if you don’t need a ton of space, you may find you have more…

When Is the Perfect Time To Move?

For Buyers, Home Prices, Mortgage RatesIt’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices will fall. But here’s what…

2025 Housing Market Forecasts

Home Prices, Infographics, Mortgage RatesSome HighlightsWondering what to expect when you buy or sell a home this year? Here’s what the experts say lies ahead.Mortgage rates are projected to come down slightly. Home prices are forecast to rise in most areas. And, there will be more…

How Mortgage Rates Affect Your Monthly Payment

Infographics, Mortgage RatesSome HighlightsExperts say rates will come down slightly in the year ahead – but some volatility is expected. So, you shouldn't try to time the market.Instead, it's better to focus on how even a small change impacts your future mortgage payment.…

Expert Forecasts for the 2025 Housing Market

For Buyers, For Sellers, Forecasts, Home Prices, Mortgage RatesWondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home? The best way to get that information is to lean on the pros.Experts are constantly updating and…