Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

The Benefits of Using Your Equity To Make a Bigger Down Payment

Affordability, Equity, For Buyers, Home Prices, Mortgage RatesDid you know? Homeowners are often able to put more money down when they buy their next home. That’s because, once they sell, they can use the equity they have in their current house toward their next down payment. And it’s why as home equity…

Now’s the Time To Upgrade to Your Dream Home

Equity, For Sellers, Mortgage RatesIf you’ve been wanting to sell your house and move up to a bigger or nicer home, you’re not alone. A recent Inman survey reveals the top motivator for today’s homebuyers is the desire for more space or an upgraded home (see graph below):But…

The Top 3 Reasons Affordability Is Improving

Affordability, Home Prices, Infographics, Mortgage RatesSome HighlightsAffordability is based on three key factors: mortgage rates, home prices, and wages.And today, it’s improving quickly as rates come down, prices level off, and wages climb. If you put your search on pause because it was too…

This Is the Sweet Spot Homebuyers Have Been Waiting For

For Buyers, Mortgage RatesAfter months of sitting on the sidelines, many homebuyers who were priced out by high mortgage rates and affordability challenges finally have an opportunity to make their move. With rates trending down, today’s market is a sweet spot for…

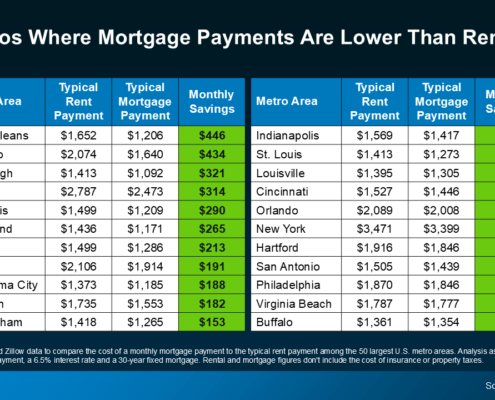

Buying Beats Renting in 22 Major U.S. Cities

Affordability, For Buyers, Home Prices, Inventory, Mortgage RatesThat’s right—according to a recent study from Zillow, in 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments (see chart below):As mortgage rates have eased off their recent peak, home prices have…

Buy Now, or Wait?

Buying Tips, For Buyers, Infographics, Mortgage RatesSome HighlightsIf you’re wondering if you should buy now or wait, here’s what you need to know. If you wait for rates to drop more, you’ll have to deal with more competition and higher prices as additional buyers jump back in. But if you…

Lower Mortgage Rates Boost Your Buying Power

For Buyers, Infographics, Mortgage RatesSome HighlightsMortgage rates are trending down and that’s great news for your bottom line.As rates drop, your monthly payment on your next home does too. Even a small change in mortgage rates can have a big impact on your purchasing power.If…

Falling Mortgage Rates Are Bringing Buyers Back

For Sellers, Mortgage Rates, Selling TipsIf you’ve been hesitant to list your house because you’re worried no one’s buying, here’s your sign it may be time to talk with an agent.After months of high rates keeping buyers on the sidelines, things are starting to shift. Rates…

Mortgage Rates Drop to Lowest Level in over a Year and a Half

For Buyers, For Sellers, Mortgage RatesMortgage rates have hit their lowest point in over a year and a half. And that’s big news if you’ve been sitting on the homebuying sidelines waiting for this moment.Even a small decline in rates could help you get a better monthly payment…

The Best Time To Buy a Home This Year

Buying Tips, For Buyers, Inventory, Mortgage RatesA shift is underway in the housing market this season. And if you’ve been sitting on the sidelines waiting for the right moment to jump back into your homebuying search, this is a great time to do it. That’s because the best week to buy…