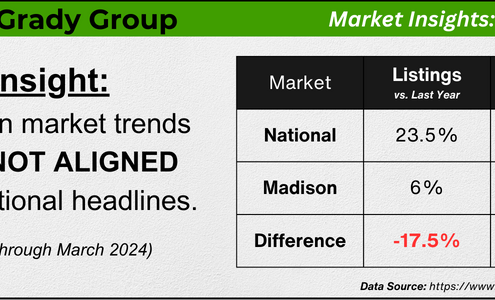

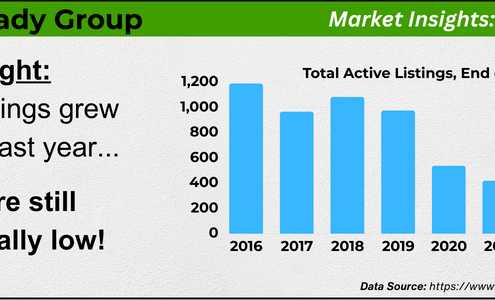

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

3 Trends That Are Good News for Today’s Homebuyers

First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

While higher mortgage rates are creating affordability challenges for homebuyers this year, there is some good news for those people still looking to buy a home.

As the market has cooled this year, some of the intensity buyers faced during…

Taking the Fear out of Saving for a Home

Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first. But it doesn’t have to be. One way to take the fear out of budgeting is understanding some of the costs you might encounter. And to…

Applying for a Mortgage Doesn’t Have To Be Scary [INFOGRAPHIC]

First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

Some Highlights

Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home.

Know your credit score and work to build strong credit. When you’re…

Pre-Approval Is a Critical First Step on Your Homebuying Journey

First Time Home Buyers, For Buyers, Move-Up Buyers

If you’re planning to buy a home this year, one of the first steps on your journey is getting pre-approved. Especially in today’s market when mortgage rates are higher than they were just a few months ago, getting a mortgage pre-approval…

Should You Still Buy a Home with the Latest News About Inflation?

First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers, Rent vs. Buy

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still high, remaining around 8%. This news impacted the stock market and added fuel to the fire for conversations about a recession.

You’re…

The Latest on Supply and Demand in Housing

First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

Over the past two years, the substantial imbalance of low housing supply and high buyer demand pushed home sales and buyer competition to new heights. But this year, things are shifting as supply and demand reach an inflection point.

The graph…

The Emotional and Non-financial Benefits of Homeownership

First Time Home Buyers, For Buyers, Move-Up Buyers, Rent vs. Buy

With higher mortgage rates, you might be wondering if now’s the best time to buy a home. While the financial aspects are important to consider, there are also powerful non-financial reasons it may make sense to make a move. Here are just…

Perspective Matters When Selling Your House Today

For Sellers, Housing Market Updates, Move-Up Buyers, Pricing, Selling Myths

Does the latest news about the housing market have you questioning your plans to sell your house? If so, perspective is key. Here are some of the ways a trusted real estate professional can explain the shift that’s happening today and why…

Four Things That Help Determine Your Mortgage Rate

Down Payments, First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

If you’re looking to buy a home, you probably want to secure the lowest interest rate possible for your home loan. Over the last couple of years, that was easier to do as the housing market saw record-low mortgage rates, but this year rates…

Saving for a Down Payment? Here’s What You Should Know.

Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

As you set out to buy a home, saving for a down payment is likely top of mind. But you may still have questions about the process, including how much to save and where to start.

If that sounds like you, your down payment could be more in reach…