Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

Should You Sell Your House or Rent It Out?

For Sellers, Selling TipsWhen you’re ready to move, figuring out what to do with your house is a big decision. And today, more homeowners are considering renting their home instead of selling it. Recent data from Zillow shows about two-thirds (66%) of sellers thought…

More Homes, Slower Price Growth – What It Means for You as a Buyer

For Buyers, Home Prices, InventoryThere are more homes on the market right now than there have been in years – and that could be a game changer for you if you’re ready to buy. Let’s look at two reasons why.You Have More Options To Choose FromAn article from Realtor.com…

What’s Motivating Homeowners To Move Right Now

For Sellers, Mortgage Rates, Selling TipsOver the past few years, some homeowners have decided to delay their move because they don’t want to sell and take on a higher mortgage rate on their next home. Maybe you’re thinking the same thing. And honestly, that’s no surprise. It’s…

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

Buying Tips, For BuyersFor over 79 years, Veterans Affairs (VA) home loans have helped countless Veterans achieve the dream of homeownership. But according to Veterans United, only 3 in 10 Veterans realize they may be able to buy a home without needing a down payment…

Why You Need an Agent To Set the Right Asking Price

For Sellers, Home Prices, Infographics, Selling TipsSome HighlightsThe #1 task sellers struggle with is setting the right asking price for their house.Without an agent’s help, you may set a price that turns away buyers and takes a long time to sell. To make sure your house is priced right,…

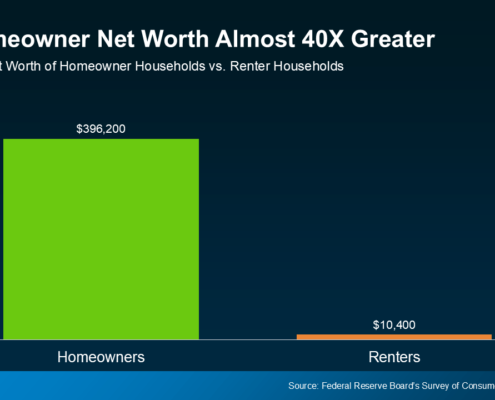

Renting vs. Buying: The Net Worth Gap You Need To See

For Buyers, Rent vs. BuyTrying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth.Every three years, the Federal Reserve Board shares a report called the Survey of Consumer Finances…

What To Look For From This Week’s Fed Meeting

Economy, Mortgage RatesYou may be hearing a lot of talk about the Federal Reserve (the Fed) and how their actions will impact the housing market right now. Here’s why.The Fed meets again this week to decide the next step with the Federal Funds Rate. That's how much…

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Agent Value, For Sellers, Selling TipsYou’ve probably noticed one thing if you’re thinking about making a move: the housing market feels a bit unpredictable right now. The truth is, from home prices to mortgage rates, we’re seeing more volatility – and it’s important to…

Is a Fixer Upper Right for You?

Affordability, Buying Tips, For BuyersLooking to buy a home but feeling like almost everything is out of reach? Here’s the thing. There’s still a way to become a homeowner, even when affordability seems like a huge roadblock – and it might be with a fixer upper. Let’s dive…

Q&A: How Do Presidential Elections Impact the Housing Market?

Economy, Home Prices, Infographics, Mortgage RatesSome HighlightsEven if you’re not looking to move right away, you may have questions about how the election will impact the housing market.When we look at historical trends, combined with what’s happening right now, we can find your answers.…