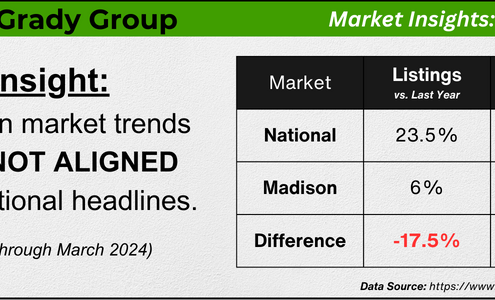

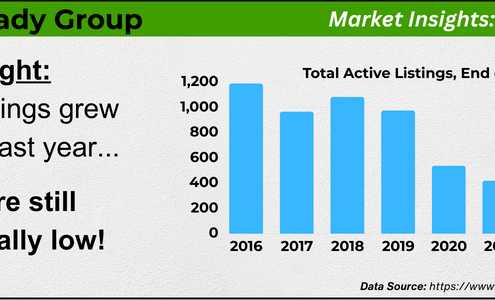

Madison’s Challenge: Escalating Prices & Sluggish Listings

Dane County Market Analysis, Housing Market Updates, Interest Rates, Market Updates, McGrady Group Blog, Pricing, Time-sensitive

Here at The McGrady Group, we love digging into the data to determine how national headlines apply to us in South Central Wisconsin. Our latest analysis delves into how Dane County’s robust employment but lackluster listing quantity influences…

The McGrady Group 2024

The McGrady Group 2024Let’s Navigate the 2024 Dane County Market Together

Dane County Market Analysis, For Buyers, For Sellers, Housing Market Updates, Industry News, Interest Rates, Market Updates, Pricing

With a competitive 2024 market upon us, The McGrady Group is excited to help our clients balance rising home prices, dynamic interest rates, and low inventory levels. The housing market's current stability, driven by economic factors and population…

More Starter Homes Are Hitting the Market

First-Time Buyers, InventoryMore entry-level homes – also known as starter homes – are popping up on the market. And after several years with very few homes available to buy and prices rising, there are finally some more options for first-time buyers.Inventory Is Increasing…

Only an Expert Agent Can Give You an Accurate Value of Your Home

Agent Value, For Sellers, Selling TipsIn today’s digital age, it’s tempting to rely on automated tools for everything — including figuring out how much your house is worth. But be careful. The automated estimates you’re seeing online often miss key details that affect the…

The Top 2 Reasons To Look at Newly Built Homes

Buying Tips, First-Time Buyers, For Buyers, InventoryWhen planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders focusing on smaller, more affordable options, this type of home may just be the key to crossing…

Why Moving to a More Affordable Area Makes Sense

AffordabilityMoving to a more affordable area could be the fresh start you need to get ahead financially. While some markets are certainly more affordable than others, know that working with a trusted real estate agent to find what fits your budget and your…

What Will It Take for Prices To Come Down?

Affordability, Home Prices, InventoryYou may be wondering if home prices are going to crash. And believe it or not, some people might even be hoping this happens so they can finally purchase a more affordable home. But experts agree that's not what's in the cards – and here's…

Why More Sellers Are Hiring Real Estate Agents

Agent Value, For Sale by Owner, For Sellers, Selling TipsPutting your house for sale on your own – often called “For Sale by Owner” or FSBO – might be on your mind. But you should know that it gets complicated very quickly, especially in today’s complex market.That’s why data from the…

Why This Winter Is the Sweet Spot for Selling

For Sellers, Infographics, InventorySome HighlightsThinking about selling your house? Here are a few reasons why you may want to do it this season.Buyers looking right now are serious about moving and the number of homes for sale is typically lower this time of year – helping…

Why Owning a Home Is Worth It in the Long Run

Home Prices, Mortgage RatesToday’s mortgage rates and home prices may have you second-guessing whether it's still a good idea to buy a home right now. While market factors are definitely important, there’s also a bigger picture to consider: the long-term benefits…

When Will Mortgage Rates Come Down?

Forecasts, Mortgage RatesOne of the biggest questions on everyone’s minds right now is: when will mortgage rates come down? After several years of rising rates and a lot of bouncing around in 2024, we’re all eager for some relief.While no one can project where rates…

Sell Your House During the Winter Sweet Spot

For Sellers, Selling TipsA lot of people assume spring is the ideal time to sell a house. And sure, buyer demand usually picks up at that time of year. But here’s the catch: so does your competition because a lot of people put their homes on the market at the same…